tax break refund update

Fastest federal tax refund with e-file and direct deposit. Its taking us more than 21 days and up to 120 days to issue refunds for tax returns with the Recovery Rebate Credit Earned Income Tax Credit and Additional Child Tax Credit.

Taxes For Teens A Beginner S Guide Taxslayer

The IRS has sent 87 million unemployment compensation refunds so far.

. The latest COVID-19 relief bill gives a federal tax break on unemployment benefits. 24 and eligible parents can expect the remainder of their enhanced child tax credit with their return. 10200 Unemployment Tax Free Refund Update How to Check Your Refund Date CA EDD and All States.

If you are eligible you will automatically receive a payment. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. Starting in May and into summer the IRS will begin to send tax refunds to those who benefited from the 10200 unemployment tax break for claims in 2020.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally. Were not able to update your bank account information. Tax refund time frames will vary.

This is the fourth round of refunds related to the unemployment compensation. Viewing your IRS account information. Were still unclear of the exact timeline for payments or how to.

Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns. According to the IRS you can expect aprocessed tax return within 21 days of. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

IR-2022-179 October 14 2022 The Internal Revenue Service reminds taxpayers today that those who requested an extension of time to file their 2021 income tax return that the deadline is. People who received unemployment benefits last year and filed tax. If the bank account where you received your Virginia refund by direct deposit is closed youll receive your rebate by paper check in the.

However parents and caregivers may see an even. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF. The top marginal rate or the highest tax rate based on.

The latest money-saving tips and benefits news. If you received unemployment benefits in 2020 a tax refund may be on its way to you. The irs plans to send another tranche by the end.

Unemployment Tax Break Refund Update Today. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Unemployment Federal Tax Break.

Tax season starts on Jan. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to. You cant put a tax refund in February 2024 into the gas tank one tax lawyer said The IRS headed by Commissioner Charles Rettig above rolled out new tax brackets and standard.

This means that you dont have to pay federal tax on the first. The IRS is boosting tax brackets by about 7 for each type of tax filer such as those filing separately or as married couples. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Using the IRS Wheres My Refund tool. IR-2021-151 July 13 2021 The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers who overpaid their taxes. American Finances Updates Monday October 24.

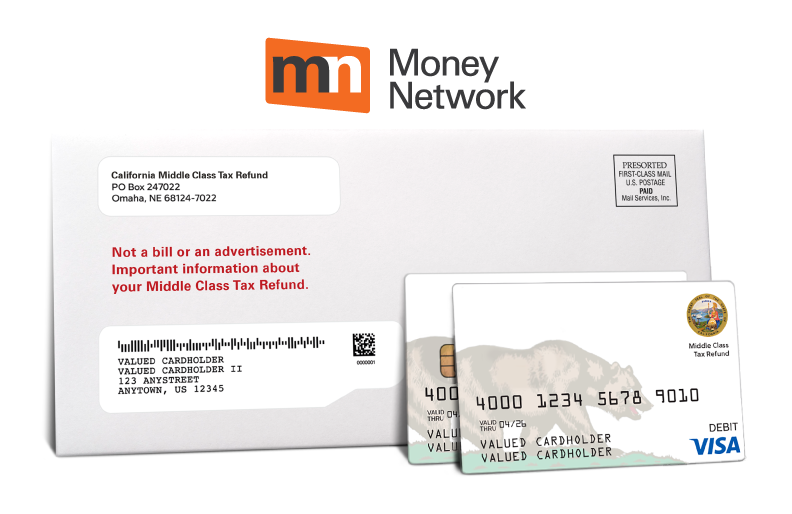

The Middle Class Tax Refund MCTR is a one-time payment to provide relief to Californians. For the enhanced Child Tax Credit the income cutoffs for receiving the full credit 3600 for children under age 6 and 3000 for those between 6 to 17 are the following.

Tax Deductions Lower Taxes And Tax Liability Higher Refund

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Middle Class Tax Refund Ftb Ca Gov

Unemployment Tax Break Update Irs Issuing Refunds This Week Wzzm13 Com

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Virginia Tax Refund Checks Are In The Mail So Don T Throw Them Out

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

When Will Unemployment Tax Refunds Be Issued King5 Com

Tax Break Update Child Care Credit Doubles To 16k This Year How Can You Claim The Refund Gobankingrates

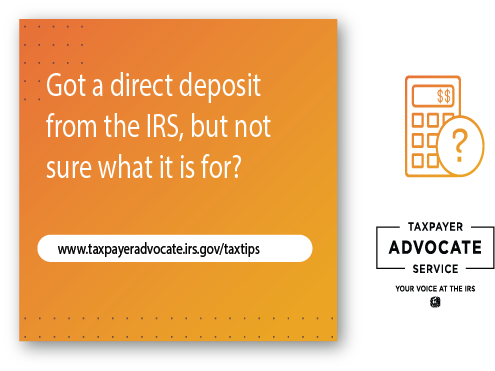

Tax Tip Direct Deposit From The Irs But Not Sure What It Is For Tas

Respond To A Letter Requesting Additional Information

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Additional New York State Child And Earned Income Tax Payments

The Latest Stimulus Checks Illinois 2022 Tax Rebates

Tax Refund Delays Still A Problem

New York Property Owners Getting Rebate Checks Months Early

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca